Someone on the board comes in hot off of a Harvard Business Review article trumpeting the benefits of a new technology. None of the competitors have adopted this technology yet and it could be a major differentiator that sparks growth. Leaders realize they need to bring in an expert and do some executive headhunting, which leads to an interview with Mr. Digital. Mr. Digital uses all the favorite buzzwords from “big data” to “machine learning.” He even throws in some naughty ones like “blockchain” and ties them all back to promises of greater ROI and organizational agility. He seems to know what he’s talking about. He seems to have a plan. Everyone is dazzled and he is hired. Within two years, he is fired.

So what went wrong? Probably a lot of things, but the pacing is often an overlooked component of technology adoption. Culture is often the biggest hurdle in capturing these opportunities. Organizations need to be honest about the role new technologies will play and what level of adoption their culture can tolerate. Doing so can help set an adoption pace that leads to sustainable change, using three key stages of adoption as milestones to chart progress.

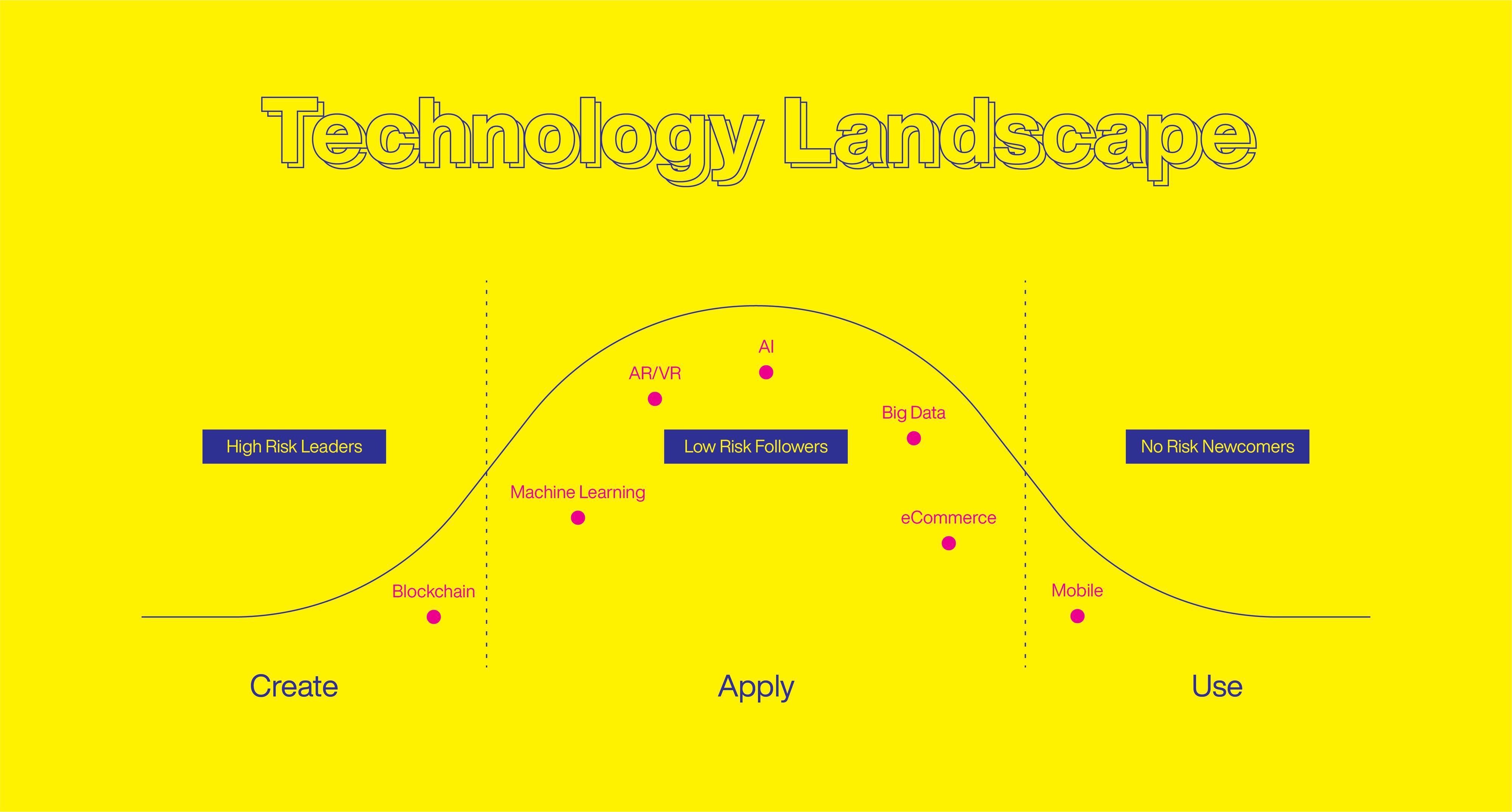

Mr. Digital comes in with grand promises, but ultimately needs to get individuals within the organization to think and act differently. This is no small task, and when talk around new technologies arise, the time and resources needed to change habits internally can get shortchanged. It is worth taking time to look across multiple industries and assess where your industry and, more specifically, your organization is on the technology adoption curve. This can help give an honest depiction of where your organization really is while pointing toward truly differentiating approaches to technology by learning from other industries.

Mapping the Bell Curve

On the left side of the bell curve are the true high-risk leaders, constantly pushing the edges of where and how technology can be used. To no surprise, these are often technology-based companies – think FANG companies and startups. The technology these companies are playing with is in an experimental phase, not yet ready for the mass market. Early technologies are "close to the metal" and require committed collaborators to mature them into viable technologies at an industry scale. Only the high-risk leaders who plan to innovate here will take the risk of creating new technologies. Their experiments can reveal the desirability of the new technology, proving out what’s viable and exploring different use cases before going to market.

Low-risk followers are not far behind. These organizations tend to operationalize technologies that the high-risk leaders have proven to be viable opportunities. They are spread across different industries and are often supported by SaaS providers. These providers make the technology more accessible for fast followers, having solved the initial usability problems and making the technology more affordable for the masses in the middle of the bell curve.

On the right end of the bell curve are no-risk newcomers who are also spread across different industries, or could be entire industries in and of themselves. They risk being dismissed by customers and talent if they are not delivering experiences that match the expectations of the broader market. They also, however, have plenty of opportunities. By this time, the technology has been proven out thoroughly. It can be implemented at a low cost and it is easier to find talent that is familiar with it. They can make quick gains in these areas and, if the entire industry is in the same position, it allows them to adopt known technologies and implement as a differentiator. If these organizations can stretch their thinking further up the bell curve, they can put a wider moat between them and the competition and still be utilizing tested and proven technologies.

Three Stages of Technology Adoption

No matter where the organization is on the bell curve, there are three high-level stages of adoption that can be used as milestones to gauge pacing: Intentional Experiences, Ease and Optimization, and Open Spaces.

Intentional Experiences means the organization is using discernment with technology. They have a purpose and a place for it and are clear on where it is useful and where it is not. They are not overbuying enterprise-level software or implementing digital experiences where a physical or personal experience would make more sense. They are becoming increasingly familiar with the technology landscape and how to use different solutions effectively.

Ease and Optimization is the next level. In this stage, organizations are not just being intentional about their use of technology, but are using it in ways that optimize internal workflows and/or brings a greater sense of ease and delight to the customer experience. Rather than adopting processes and experiences that are dictated by tools, organizations are customizing tools to solve for their own UX needs. They are not just keeping up with their industry's standard use of technologies, but implementing it in a way that hits the top and bottom line.

Finally, organizations are using technology to create Open Spaces within their industry. The culture has shifted to think through a digital lens. Although only a select few within the organization may be charged with being technology evangelists and educators, everyone is comfortable with emerging terms and use cases. Technology has a greater impact on the offer and direction of the organization, potentially leading to new markets and open spaces, generating new sources of value for the organization.

These descriptions of technology adoption are more of a rule of thumb than definitive, but are hopefully helpful in giving a general sense of where your organization may be on the bell curve. The more we can understand the gap between where our organizations and industries are, the more we can identify new opportunities for differentiation and growth.