Peopledesign

The Built Environment

Furniture

Lighting

Textiles/Upholstery

Flooring/Carpet

Building Materials

AE Firms

Growth Cycles

Where are you on the growth curve?

Knowing your position on a growth curve can help focus your strategy.

Waves are a way to understand the world. Consider ocean waves, light waves, and electromagnetic waves. Quantum physics challenges us to consider particles as waves.

We don’t have to understand wave theory to know that waves are cycles that ebb and flow. In fact, thinking about waves as “S-curves” in the context of business has been around for at least a hundred years.

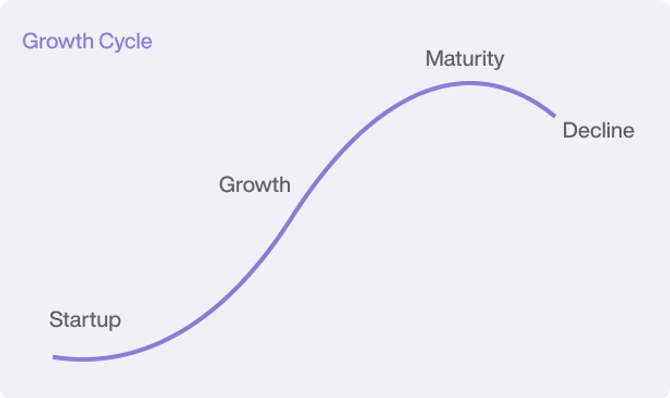

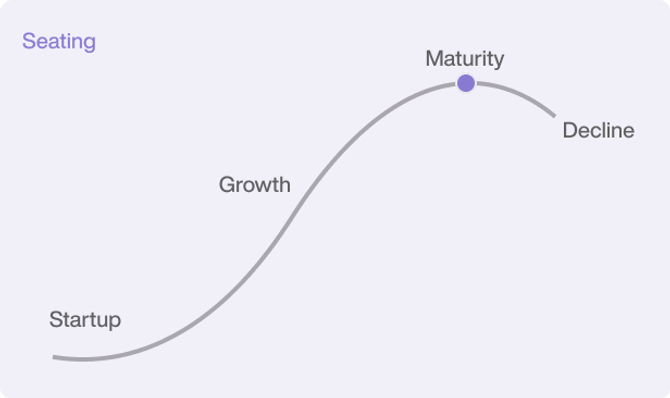

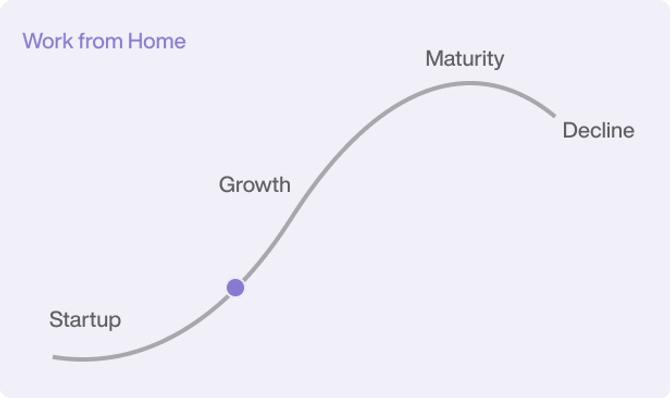

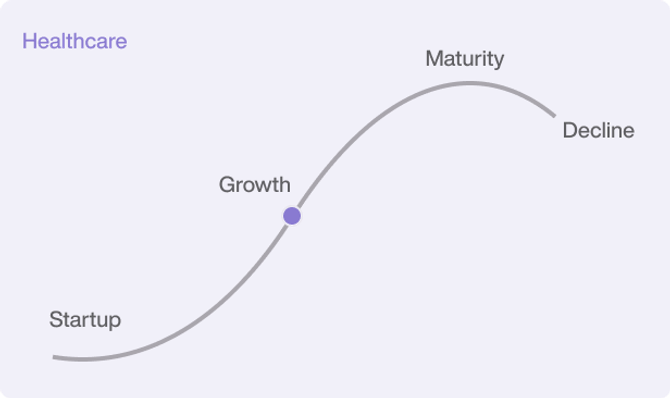

The growth cycle from startup through growth, maturity, and decline can help us understand how products, companies, markets, and entire industries evolve.

A Mature Market

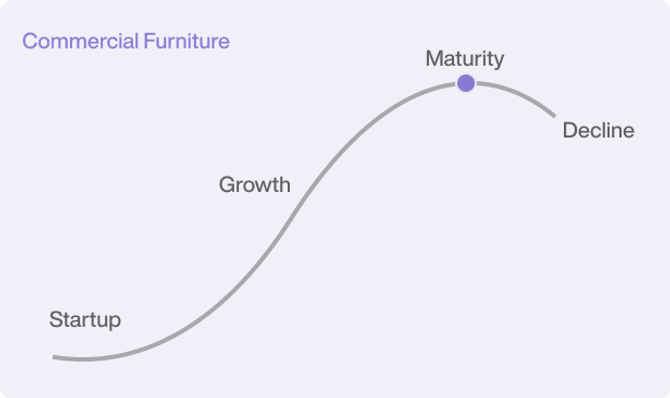

The commercial furniture industry we know is mature. The rise of office work in the 1960s and 1970s led to tremendous growth of systems furniture and ergonomic seating in the 1980s and 1990s.

Product categories, selling models, standards, and competitors are well-known today. While the category may not be wholly in decline, the industry consolidation we have seen in recent years indicates market maturity.

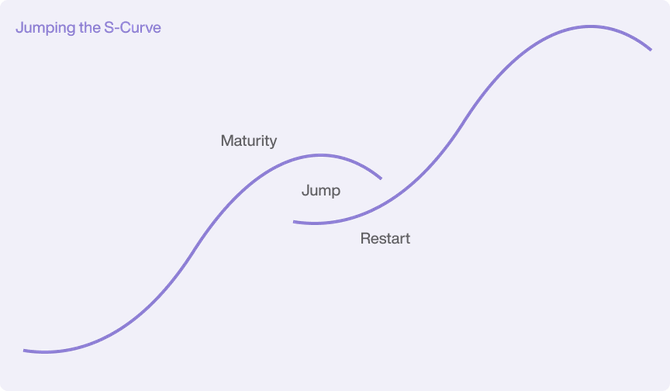

High-performing firms see consistent growth, profitability, and return of shareholder value beyond their peers. In their book, Jumping the S-Curve, authors Paul Nunes and Tim Breene looked for patterns of enduring success and observed how leading companies “jump” from one growth curve to the next.

While it seems impossible to continuously outperform competitors in mature industries, high performance is not dependent on industry health. Jumping the S-curve is essential to avoid eventual decline. Finding your place on the growth curve to inform your strategy is critical for innovative, sustainable companies.

Systems Decline and Reinvention

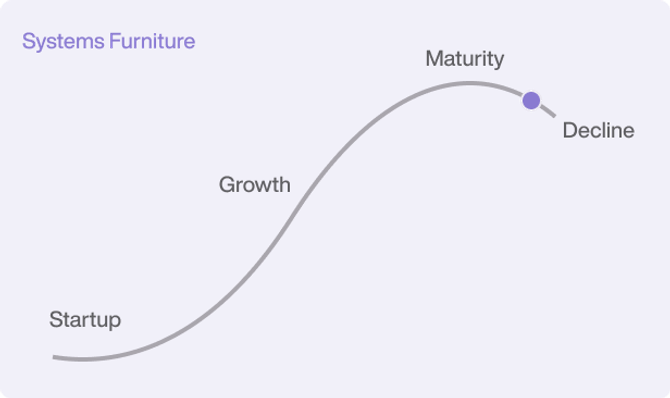

Reinvestment in infrastructure is a positive signal for the category, but we know traditional systems furniture is declining. Between the downward pressure to reduce cost, ideas about open collaboration, and cultural touchstones from Dilbert to Office Space, cubicles became very uncool in the 2000s and 2010s.

Today, we may be seeing a renaissance of systems products through sub-architecture. Walls products are not new, but continued manufacturing advances and a need for higher-performing environments have sparked renewed interest in modular construction.

For makers and sellers, switching from selling panels to walls is a nontrivial change. While furniture players often consider A&D (Architects and Designers) as a homogenous group, FF&E (Furniture, Fixtures, and Equipment) mostly appeals to interior designers (“D”) rather than architecture directly (“A”). Architectural products go beyond FF&E and aligns more closely with the world of AEC (Architecture, Engineering, and Construction) and CRE (Corporate Real Estate).

Even stand-alone cubicles or “pods” are seeing new life. These productized systems are sold as a single SKU rather than a kit of parts. This evolution may be a tacit acknowledgment that reconfigurable offices aren’t reconfigured as much as we had imagined.

Nunes and Breene highlight what it takes to climb and jump S-curves, including a commitment to seeking new competitive market insights, building new capabilities, and strategically focusing on talent. Industry competitors willing to make changes to enable a different kind of sale may find renewed growth.

Places to Sit

Seating may not be on the decline, but it certainly isn’t new. New materials, novel ergonomic solutions, and targeted functions will continue to play a role, but the category is mature and crowded. While emerging work-from-home (WFH) or gaming audiences offer new opportunities, fundamentally differentiated product solutions are not likely.

People need places to sit. Seating may be evergreen, but who buys these chairs and how they are viewed and used will continue to evolve. For example, offices that support less traditional work open new possibilities beyond work chairs, including soft seating and other casual interactions.

The pandemic fanned a decades-long WFH flame, and the communications technology has arrived in time to allow companies beyond Silicon Valley to reimagine work less reliant on physical locations. The pendulum continues to swing, but WFH is a growth category with new market dynamics and competitors, opening new growth opportunities.

Beyond chairs, what will home offices be like in the coming years? How will they be planned, outfitted, and maintained? What are the expectations and emerging requirements? Who will serve this built environment?

Primary or Ancillary?

“Ancillary” products—that is, products beyond traditional systems and seating—continue to grow as offices are reframed as desirable destinations competing with coffee shops and home offices for attention.

Less conventional collaboration spaces aren’t just for Google anymore; younger workers are more likely to expect bean bag chairs at the office than in their living rooms. If this category includes acoustics, lighting, and more, we’ll need a better name for this growing category.

Segment Specialization

Market segments offer another lens. Between an aging population and a greater awareness of well-being, Healthcare is a perennial growth segment. Any growth areas lead to increased specialization, and competitors fight to claim a niche position and offering. Bigger targets attract even more competitors, but Healthcare has a deep well of growth opportunities for specialized players willing to commit and invest.

Other markets offer opportunities for growth through specialization, including education, hospitality, and retail. Not every segment will have the same appetite for deep niche specialization as Healthcare, but each has different needs, trends, concerns, and market cycles. Optimizing a business tailored to specific unmet segment needs will win over generalist firms attempting to play in all categories.

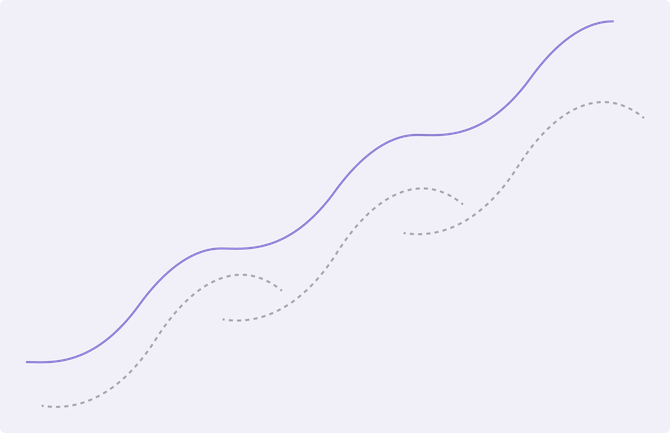

Waves of Innovation

Beyond product and market categories, where is your company on the growth cycle? Are you in a startup or growth mode? Is your company mature or in decline? How about your target market? Are you aligned with other growth segments? How about your your product portfolio? Where will the next wave of innovation come from?

Keeping your head above the waves is the job of any leader. Nunes and Breene describe staying ahead of the curve by finding and capitalizing on a “Big Enough Market Insight” (or BEMI). They note that high performers make substantial investments to understand new sources of value for informed leaps into the future.

How will you find new growth? Are you investing to find your BEMI? What is your approach to staying ahead of changes in competition, capabilities, and talent? A clear future vision helps innovative companies surf the waves of change.