Peopledesign

The Built Environment

Furniture

Lighting

Textiles/Upholstery

Flooring/Carpet

Building Materials

AE Firms

The Shape of Scale: How Consolidation is Restructuring Contract Furniture

The Shape of Scale

How Consolidation is Restructuring Contract Furniture

As the majors get larger and the channels tighten, leaders across the built environment must revisit their positioning, brand strategies, and go-to-market assumptions.

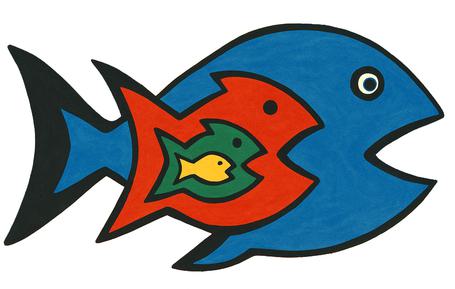

Market consolidation is an indicator of maturity and decline. The big fish eat the little ones as they scramble for market power, customer lock-in, and channel control. Consolidation is abundant within contract furniture. HNI's recent acquisition of Steelcase is the latest major shake-up, Herman Miller buying Knoll to become MillerKnoll, and HNI scooping up Kimball International, among other deals, signal an industry tipping point. All industry players must be ready to pivot.

The benefits of consolidation can be significant. With the right coordination, larger firms can enjoy operational efficiencies, eliminate duplicate functions, reduce costs through economies of scale, and gain bargaining power over suppliers, customers, and geographies. Increased access to product IP, technology, and talent can lead to formidable companies that can increase their distance from competitors.

However, integration challenges can slow progress. Aligning leadership direction, internal systems, product strategy, and culture can be complex. We can expect restructuring, layoffs, and talent retention to be issues. Leaders must move decisively to ensure that one plus one equals three rather than one and a half, which too often happens.

Brand Consolidation

M&A branding can be complicated. Consolidation often exacerbates complex portfolios, leading to brand confusion and requiring realignment of strategic brand architecture. Today, each major contract furniture player – HNI-Steelcase, MillerKnoll, and Haworth – has become a rollup of multiple brands. Each individual brand requires an adequate investment to remain vital. Even at their larger size, the majors likely have too many brands and too many products. Sorting out a brand portfolio gets complicated quickly as companies attempt to retain each brand’s value while leveraging the benefits of consolidated optimization.

Even if all the brands are worth keeping, developing a cohesive narrative can be tricky. The large brands need to avoid simply becoming competing furniture malls. Each legacy brand has its own story, which can strengthen but confuse the overall picture. Leaders will define precise positioning and consider how a collection of brands works together. While a single brand may align with a target segment, specifiers must make sense of and understand how to benefit from a comprehensive offering.

Channel Consolidation

Channel disruption causes friction with dealers, independent reps, distributors, and retailers feeling the heat. There will be fewer dealers as small players may get squeezed out or repositioned as niche service providers. Herman Miller and Knoll had more direct overlap than HNI and Steelcase, so this integration may be more straightforward. HNI’s mid-market juggernaut HON operates primarily outside of the higher-end contract marketplace. The primary exception today will be Allsteel, HNI’s contract brand.

While major furniture manufacturers become larger, their influence over the built environment is lessening. At one time, majors drove most of the business among dealers with aligned relationships. Today, many dealers have diversified their businesses into products beyond furniture and more holistic services. Consolidation is happening among dealers themselves, creating megadealers. Megadealers are a new force in the marketplace – regional powerhouses becoming brands in their own right that legitimately support the built environment more holistically. The rise of megadealers suggests a strategic reshaping of the dealer ecosystem.

The concentration of power emerges when fewer players dominate the market, improving consistency, impacting pricing, and potentially stifling innovation. The barrier to entry rises for smaller or newer firms that face higher costs to compete on scale, service, or technology. Larger enterprise customers may benefit from national/global service consistency, while smaller clients may seek personalized service elsewhere.

Smaller manufacturers will become more specialized compared with larger generalist firms. Under the canopy of major global players, niche, differentiated players could win by offering greater agility, customization, unique design, sustainability, and service. Smaller providers must establish, maintain, and grow an effective network of independent rep groups.

Independent reps are already the lifeblood of many niche firms. As dealers become larger and manage increasing manufacturers and SKUs, smaller brands must find ways to break through. Empowering reps with the right products, stories, and tools becomes essential to remain competitive.

Digital Consolidation

Consolidation accelerates digital transformation. Large manufacturers and dealers will look for ways to leverage technology to improve efficiency and customer experiences. Consolidated firms will invest heavily in AI, BIM integration, and digital twins. Smart furniture and IoT-enabled workplaces will continue to inspire and seep into product roadmaps to lure tech-savvy consumers and more. The rise of platforms and digital ecosystems leads integrated firms to double down on digital channels, data analytics, and procurement platforms.

While large firms may attempt to create proprietary technology, the market will reward integration and process normalization. The success of CET in recent years is a good example of how traction stems from interoperability. Open technology is good news for smaller firms. Even though price can be a barrier, they can participate in an emerging digital marketplace. Even more, startups and smaller firms have greater latitude in adopting digital-native strategies, leaving legacy channel patterns behind.

Global Consolidation

The consolidated major players have a global footprint. An international sales, design, and distribution network is a clear competitive advantage for serving the largest enterprise customers. However, the evolving trade policy is a universal problem that will complicate global offerings. While large companies will sell to other large companies, niche firms can earn smaller, localized, incremental business with fewer resources and less bureaucracy.

Companies based outside North America are looking to enter the market. Large European and Asian competitors may emerge as new contenders through acquisitions, further creating consolidated global brands. The most prominent global players will be operating at one level, with smaller, local players operating at a different level.

In addition, the pressure for sustainable solutions will continue. Global standards set by industry groups like BIFMA and USGBC, driven by influential A&D firms, will continue to frustrate and inspire. Larger project participants face greater scrutiny on circular economy practices, material sourcing, ESG compliance, and life-cycle. The larger companies have more resources to address these issues, but more complicated supply chains to wrangle.

Consolidation Opportunities

As commercial furniture firms consolidate, they become part of larger ecosystems within the built environment. There will be more blurring between sectors, such as integrated workplace solutions (real estate, technology, data), design-build alignment (increased A&D collaboration, construction, sub-architecture), and a focus on experience (pivot from selling “things” to delivering “spaces”). Platform-based service models like furniture-as-a-service are another likely trend as businesses rethink their facilities, ownership, and investments.

Tightly positioned brands may focus exclusively on specific vertical market segments like education, healthcare, hospitality, or government. Among the innovation paths for these firms could be vertical integration, which involves going deeper to address customer needs that extend the products and services beyond the conventional offering. Manufacturers securing specialized offerings, supply chains, and distribution can protect customer relationships and margins.

The fragmented middle of the market may attract Private Equity interest to roll up or consolidate challenger brands. With an eye toward aggressive growth, PE culture may conflict with an industry full of family-owned, decades-old firms with roots in manufacturing rather than Wall Street. Approaches to meaningful engagement may help close the culture gap. However, industry incumbents can also take this attitude, considering how to roll up like niche competitors or look for firms in adjacent industries to create new, disruptive players that think and act differently.

What's Next

We will likely see even more M&A activity in the near term, especially dealer-to-dealer and mid-market rollups. Product and brand reconciliation work is underway to resolve overlaps and clarify portfolios. Channel confusion and disruption will create opportunities for nimble players.

A bit farther out, we’ll likely see more integrated national or global service models that compete with local customization. Accelerated investments in technology, including AI and digital procurement tools, will begin to have an impact. The bifurcation between highly consolidated firms and hyper-specialized challengers will become more evident, pressuring smaller firms to outpace the majors and challenging large firms to remain agile.

In the long term, the industry will continue restructuring toward ecosystems that blend furniture, tech, real estate, and services. Experience-centric value propositions, shifting from product to outcome, will win over commoditized product offerings. Service will be a differentiating factor as measured by engagement through customer experience. New business models include subscriptions, workspace-as-a-service, and integrated design/delivery platforms.

Consolidation is often a lagging indicator of broader change. It reflects a maturing market – slower growth, increased competition, and saturation across product categories. Still, long-term demand for environments that support changing work and lifestyle needs remains strong. Pay attention to forward-looking signals: venture capital activity, startup momentum, and the pace of innovation. These leading indicators will point to the next wave of meaningful growth.